Market Integrity Update - Issue 78 - December 2016

Issue 78, December 2016

- Hochtief AG agrees to give up notional profits after being fined for insider trading

- CommSec pays $200,000 infringement notice penalty

- ASIC commences proceedings against State One for failing to comply with market integrity rules

- Sydney man convicted after pleading guilty to insider trading

- MoneySmart launches digital toolkit to help Australians navigate financial advice

- ASIC updates guidance on financial information in prospectuses

- End of year window dressing

- ASIC consults on ‘sunsetting’ class orders for markets

- Stories from the beat

- What's new?

Hochtief AG agrees to give up notional profits after being fined for insider trading

The Federal Court of Australia has found that German construction group holding company Hochtief Aktiengesellschaft (Hochtief AG) engaged in insider trading in contravention of section 1043A(1)(d) of the Corporations Act 2001 (Corporations Act). The court has ordered Hochtief AG to pay a penalty of $400,000, as well as ASIC's legal costs.

In reaching its decision, the court found:

- on 14 January 2014, at an Audit Committee meeting of Leighton Holdings Limited (Leighton Holdings) (now CIMIC Group Limited), Hochtief AG came into possession of information about Leighton Holdings’ expected financial result for the year 31 December 2013, which it ought reasonably to have known was inside information

- on 27 January 2014, while in possession of the inside information, Hochtief AG extended the completion date for the acquisition of Leighton Holdings shares by its subsidiary Hochtief Australia Holdings Limited (Hochtief Australia) from 31 January 2014 to 14 February 2014 (Variation of Instruction), and

- on 29 January 2014, while in possession of the inside information, Hochtief AG issued the Variation of Instruction to various directors and officers of Hochtief Australia, procuring Hochtief Australia to acquire 200,000 Leighton Holdings shares for $3,244,156.97 (including fees).

In handing down his judgment, Wigney J. said:

'While the contravention did involve carelessness and inadvertence, rather than actual knowledge and deliberateness, the careless was such as to amount to a serious failure to exercise appropriate care and diligence in the circumstances. It also involved a serious failure on the part of Hochtief AG to put in place appropriate systems and procedures relating to insider trading. It resulted in significant trading in a major Australian public company which, because it involved insider trading, had the capacity to significantly undermine the integrity and efficiency of the relevant securities markets. It was by no means a victimless crime: the victim was the market.'

On 8 December, we issued an order (under section 91 of the Australian Securities and Investments Commission Act 2001) to recover our investigation expenses and accepted an Enforceable Undertaking (EU) from Hochtief AG. In accordance with the EU, Hochtief AG will make a voluntary contribution of $103,400 to both the Australian Shareholder Association (for shareholder education and/or company monitoring) and the First Nations Foundation (for its adult financial literacy program).

These amounts represent the notional profits made by Hochtief Australia as a result of Hochtief AG's contravention.

ASIC Commissioner Cathie Armour said, 'It is crucial to the efficiency and integrity of the financial markets that everyone has access to the same information. In particular, companies must understand the added risk of engaging in insider trading when their officers hold multiple directorships, particularly officers of majority shareholders.'

- Listen to Commissioner Cathie Armour discuss the case in our podcast

- Read the media release (refer: 16-430MR)

CommSec pays $200,000 infringement notice penalty

Commonwealth Securities Limited (CommSec) has paid a penalty of $200,000 to comply with an infringement notice given to it by the Markets Disciplinary Panel (MDP).

On 25 March 2014, CommSec was notified of the death of one of its clients. At that time, CommSec failed to apply a holder record lock to either of the client’s two accounts.

Between 25 March 2014 and 14 October 2014, CommSec entered into 59 market transactions on behalf of the client on the instructions of a family member; the transactions were then allocated to the deceased client’s accounts. The family member was not authorised to provide instructions to enter into any of the market transactions.

During this time, CommSec’s deceased estate area was undergoing an internal restructure causing a backlog of deceased estate work, including failures to apply holder record locks to a number of deceased clients’ accounts.

The MDP was satisfied that, although CommSec had developed deceased estate policies and procedures to prevent unauthorised trading on deceased client accounts, they were not properly implemented, integrated or monitored.

The MDP had reasonable grounds to believe that CommSec contravened subsection 798H(1) of the Corporations Act by failing to comply with Rules 2.1.3 and 3.3.1 of the ASIC Market Integrity Rules (ASX Market) 2010. Compliance with the infringement notice is not an admission of guilt or liability, and CommSec is not taken to have contravened subsection 798H(1).

ASIC commences proceedings against State One for failing to comply with market integrity rules

We have commenced civil penalty proceedings against State One Stockbroking Ltd (State One) in the Federal Court of Australia for failing to comply with an infringement notice given to it by the MDP.

We have commenced civil penalty proceedings against State One Stockbroking Ltd (State One) in the Federal Court of Australia for failing to comply with an infringement notice given to it by the MDP.

On 31 March 2016 the MDP gave State One an infringement notice for:

- making bids on behalf of a client when it should have suspected that the client placed the orders with the intention of creating a false or misleading appearance in the market or price of a stock, and

- failing to provide clear guidance to the employees responsible for reviewing post-trade alerts on what to do in the event of receiving such alerts.

The MDP specified a pecuniary penalty of $425,000 in the infringement notice. State One has not complied with the infringement notice.

Since August 2010 the MDP has issued 51 infringement notices for alleged contraventions of the market integrity rules. All but one has been complied with.

The issue of an infringement notice is only an allegation of contravention of subsection 798H(1) of the Corporations Act. Although we cannot enforce an infringement notice, we may bring civil penalty proceedings if the recipient does not comply with it.

Sydney man convicted after pleading guilty to insider trading

Sydney man, Fei Yu, has been convicted of insider trading after pleading guilty to one rolled-up charge and formally admitting to a second insider trading offence.

Sydney man, Fei Yu, has been convicted of insider trading after pleading guilty to one rolled-up charge and formally admitting to a second insider trading offence.

Mr Yu has been released on a 12-month good behaviour bond. He is required to pay a penalty of $10,000 and has agreed to pay the net profits of his offences ($17,527) to a charity. He will also be automatically disqualified from managing a corporation for five years.

Mr Yu admitted to trading on inside information about a proposed takeover of Veda Advantage Limited by Pacific Equity Partners. The accounts used to make the trades were held in the name of Mr Yu’s mother and an associate.

Mr Yu received the inside information from close friend, Mr Bo Shi Zhu, who was an executive in the corporate finance advisory division of Caliburn Partnership Pty Ltd (now Greenhill & Co Inc) who were advising Veda on the proposed takeover. Greenhill & Co cooperated with ASIC throughout the investigation.

The alleged insider trading activity was identified by ASIC’s market surveillance team and referred to ASIC’s markets enforcement team for investigation and enforcement action.

ASIC Commissioner Cathie Armour said ‘ASIC is focused on deterring insider trading conduct wherever it occurs. Every prosecution is another important step in promoting confidence in the integrity of Australia’s financial markets.’

Mr Yu is the third person convicted of insider trading offences following ASIC’s investigation into officers of Hanlong Mining Investment Pty Ltd, although Mr Yu had no direct association with this company (refer: 13-027MR and 16-070MR).

MoneySmart launches digital toolkit to help Australians navigate financial advice

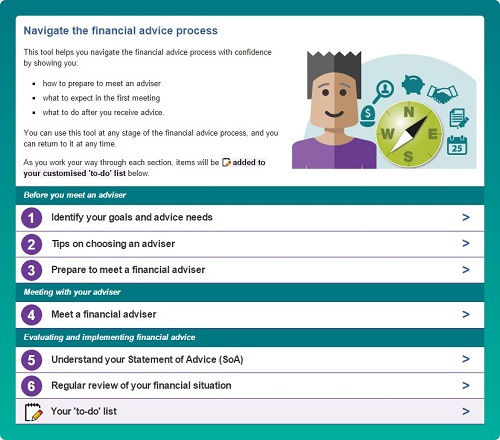

A new online toolkit developed by ASIC’s MoneySmart will help Australians to better understand and navigate the financial advice process.

The MoneySmart Financial Advice Toolkit is a free educational tool that breaks down the complexity around the financial advice process. It will assist consumers with their research and help them evaluate the financial advice they receive.

The toolkit provides an overview of the financial advice process and gives impartial guidance on:

- identifying financial goals and advice needs

- tips on choosing an adviser

- preparing to meet a financial adviser

- understanding your Statement of Advice, and

- reviewing your financial situation.

Consumers can use the toolkit to create a customised ‘to do’ list which they can modify to suit their personal financial needs. The toolkit also includes links to our Financial Advisers Register where consumers can check an adviser’s credentials – including whether they have ever been banned or disqualified from providing financial services.

The digital tool complements and supports ASIC’s regulatory and enforcement work in the financial advice sector and is designed to improve demand-side capability at critical financial moments.

ASIC updates guidance on financial information in prospectuses

If you are advising a company planning on listing, be aware that the financial information needed in a prospectus takes time to prepare.

If you are advising a company planning on listing, be aware that the financial information needed in a prospectus takes time to prepare.

The financial information in prospectuses is a key area of focus for ASIC in our prospectus reviews. Failure to include the appropriate information may result in considerable delays and costs for companies.

We recently updated Regulatory Guide 228 Prospectuses: Effective disclosure for retail investors to confirm that, in most cases, three years of audited financial information (or two years audited and a half year reviewed, depending on the date of the prospectus) should be included. This applies regardless of the corporate form of the business before seeking to list.

The updated guidance provides clarity on our disclosure expectations, including:

- that audited financial information for significant acquisitions is generally expected for two financial years because of its relevance to investors

- that some qualifications of audit and review opinions will mean that financial information is not sufficiently reliable for investors, and

- that historical financial information may need to be updated depending on the time between the date of the information and the offer.

Regulatory Guide 228 includes a number of common scenarios to illustrate our expectations of financial information included in prospectuses.

ASX has also updated its listing rules and associated guidance. ASX will now require audited financial information for a minimum of two years for an entity seeking admission to listing (including any significant acquisitions) under the assets test. More information can be found on the ASX website.

End of year window dressing

In the lead up to the end of the year we sometimes see an increase in unusual trading activity known as ‘window dressing’. Window dressing is a form of market manipulation and can affect share price valuations and end of financial year performance figures.

In the lead up to the end of the year we sometimes see an increase in unusual trading activity known as ‘window dressing’. Window dressing is a form of market manipulation and can affect share price valuations and end of financial year performance figures.

Window dressing occurs when orders that disproportionately affect share prices are placed at or near the close of trading. It is usually carried out by individuals who have an incentive to manipulate prices in or near reporting periods, such as those who periodically report to clients about investment performance.

You should take steps to identify possible misconduct through:

- system controls and filters, and

- reviews of anomalous trading by designated trading representatives and compliance staff.

You must notify ASIC if you observe or suspect window dressing. This can be done through Form M57 Suspicious Activity Report (SARS) on the market entity compliance system (MECS) portal or by emailing SARS to markets@asic.gov.au.

We will be monitoring any trading that increases prices near the end of reporting periods that may be indicative of market manipulation. If we identify conduct that should have been reported to ASIC, but wasn’t, we will contact you for an explanation.

Further information about SARS is provided in Regulatory Guide 238 Suspicious activity reporting.

ASIC consults on ‘sunsetting’ class orders for markets

This month we have released two consultation papers on proposals to repeal class orders that are due to expire (‘sunset’) in 2017.

This month we have released two consultation papers on proposals to repeal class orders that are due to expire (‘sunset’) in 2017.

All class orders are repealed automatically or ‘sunset’ after a period of time. This helps make sure they are kept up to date and only remain in force while they are relevant and fit for purpose.

In Consultation Paper 275 Repealing ASIC class order on FSG exemption for market-making services on a licensed market: [CO 03/578] we have reconsidered the legal basis of [CO 03/578] and determined that it is no longer necessary and that market makers on licensed markets should not be required to provide a financial services guide (refer: 16-416MR).

We are also proposing to repeal a number of class orders in Consultation Paper 273 Repealing ASIC class orders on holding client assets because we believe they are no longer necessary and, where relief may be needed, it would be more appropriate to provide it on a case-by-case basis (refer: 16-405MR). The relevant class orders are:

- Class Order [CO 03/1110] Prime brokerage: Relief from holding client property on trust

- Class Order [CO 03/1111] Prime brokerage: Relief from holding scheme property separately, and

- Class Order [CO 03/1112] Relief from obligation to hold client money on trust.

We welcome your feedback on these proposals, including whether repealing these class orders would impose a regulatory burden on businesses. Find out more about sunsetting class orders.

Stories from the beat

We recently came across a situation where a key person on an AFS licence left the organisation. The key person was required as a condition of the AFS licensee's ability to provide a particular financial product.

We recently came across a situation where a key person on an AFS licence left the organisation. The key person was required as a condition of the AFS licensee's ability to provide a particular financial product.

AFS licensees have obligations under section 912A(1) of the Corporations Act to have adequate resources (including staff) to provide financial services covered by the AFS licence. This includes ensuring AFS licensee representatives are adequately trained and competent to provide these financial services. If the AFS licence includes a ‘key person condition’ and a key person leaves, they need to be replaced or adequate reasons given to ASIC to demonstrate that there is continuing organisational competence for all financial products.

The AFS licensee notified ASIC that the key person had left the organisation. We then contacted the AFS licensee to discuss who was providing expertise in relation to the particular financial product. The AFS licensee advised that they had not yet found a replacement and ceased providing the product in question.