ASIC has released research exploring the consumer experience of internal dispute resolution (IDR) procedures across the financial services sector.

The research sought to better understand the experience of people thinking about or making a complaint to a financial services firm.

The research revealed the incidence of complaints across the financial services sector, as well as the barriers and difficulties people face in approaching and navigating the complaints process.

Key findings of the research were:

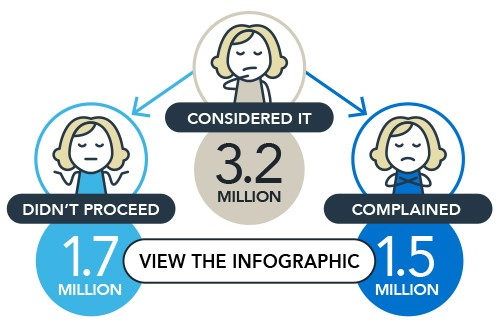

- 17% of Australians aged 18+ considered making a complaint to a financial firm in the preceding 12 months ('the considerers')

- 8% went on to make a complaint ('the complainants')

- almost half of those who did not make a complaint reported that they did not think it would make a difference or it was not worth their time, and

- 18% of complainants dropped out or withdrew their complaint before it was concluded.

Common obstacles that were encountered by complainants that directly affected their satisfaction and/or confidence in the complaints process include:

- Structural obstacles: one in seven complainants found it difficult to find the firm’s contact details to make a complaint

- Transparency obstacles: Almost a quarter of complainants did not have the IDR process explained well at first contact and 27% of complainants were unsure of how long they would need to wait for a decision, and

- Customer service obstacles: 28% of complainants reported feeling that they had not been listened to or heard and 22% felt they had been passed around to too many people or strung along.

Only 45% of complainants who received an unfavourable outcome received an explanation of the decision made against them by the firm and only 21% of complainants whose complaints were not resolved in the timeframe set by ASIC guidance had the external dispute resolution (EDR) process explained to them.

ASIC was particularly concerned about this finding since each of these steps is essential to assist consumers to effectively escalate their complaint to an independent and external forum. Since 1 November 2018, this forum has been the Australian Financial Complaints Authority (AFCA).

ASIC Commissioner Ms Danielle Press said, 'As the first step in the financial dispute resolution system, IDR plays a vitally important role in Australia’s consumer protection framework.

'Consumers and small businesses should have access to transparent, fair and timely complaints processes. Our research shows the strong connection between consumer satisfaction in how a firm deals with a problem, and their confidence in that financial firm.

'Making a complaint can be a stressful exercise for many people and that there are clear opportunities for financial services firms to improve consumer experience and outcomes', Ms Press said.

Next steps: improving IDR outcomes and transparency

The release of this research is the first step in a coordinated body of work that ASIC is undertaking to raise financial services IDR standards and transparency.

Industry action

All financial firms should closely review the research findings and consider whether their complaints procedures need to be reformed to improve the experience for consumers and to ensure that identified problems are remedied effectively and promptly. Firms should also prepare to engage with ASIC about its review of the complaints handling standards and requirements.

IDR onsite visits

A specialist ASIC team has been set up under ASIC’s Close and Continuous Monitoring Program to conduct onsite monitoring of the IDR functions at NAB, CBA, Westpac and ANZ, as well as AMP. The ASIC team will review and assess target firms’ IDR arrangements (including processes, practices, resourcing, communications, governance and reporting) and will map and evaluate their systems capabilities.

The first onsite review commenced in November 2018.

Review of ASIC standards and guidance

All financial firms that deal with retail clients and all superannuation trustees must have IDR procedures that meet ASIC’s standards and requirements.

From February 2019, ASIC will be consulting publicly on a review of existing IDR guidance set out in Regulatory Guide 165, Licensing: Internal and external dispute resolution. This review will consider, amongst other matters:

- the definition of 'complaint' i.e. what triggers the IDR process;

- requirements for complaints that are resolved immediately or within 5 business days

- maximum IDR timeframes across all complaints including superannuation related complaints, and

- written reasons for decisions made by superannuation trustees about complaints.

IDR data reporting

The legislation establishing AFCA introduced specific IDR-related reforms, including the requirement for financial firms to report IDR performance data to ASIC on an ongoing basis. ASIC also has new powers to publish the IDR data on a firm-by-firm basis.

ASIC will be consulting on the proposed data collection and reporting framework as part of the broader policy consultation mentioned above.

Both the broad IDR policy reforms and the proposed data collection framework will be informed by insights from the consumer research and findings of the IDR onsite program.

Download