Australian financial services (AFS) licensees are required to ensure the information recorded on the Financial Advisers Register about their relevant providers, is accurate and complete. This includes accurately recording how a relevant provider has met the qualifications standard.

To assist AFS licensees and their relevant providers to identify incorrect or outdated information on the Financial Advisers Register, ASIC has made the following temporary dataset available.

Industry sometimes uses the terms ‘relevant provider’ and ‘financial adviser’ interchangeably.

Qualification and training information to be recorded on the Financial Advisers Register

Qualifications and training courses completed by a relevant provider that are relevant to the provision of financial services must be recorded on the Financial Advisers Register.

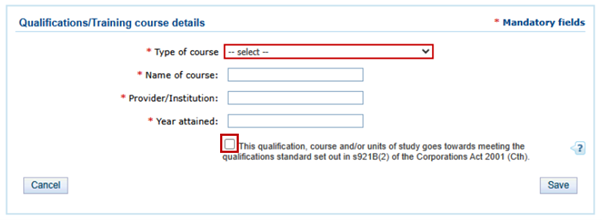

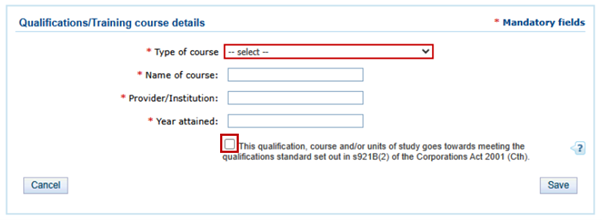

If the relevant provider has met the qualifications standard, all of the qualifications or training courses that go toward the relevant provider meeting the qualifications standard, should be recorded on the Financial Advisers Register. Importantly, these qualifications and courses need to be marked as a ‘qualification, course and/or unit of study that goes towards the relevant provider meeting the qualifications standard as set out in s921B(2) of the Corporations Act 2001 (Cth)’ by selecting the check box, see the example below.

Example

If a relevant provider is an existing provider and has a relevant degree and an advanced diploma of financial planning (ADFP), they are required to complete an Ethics for Professional Advises bridging unit to meet the qualifications standard.

Once the relevant provider has completed the bridging unit, the AFS licensee should mark each of the relevant degree, ADFP and the bridging unit as a ‘qualification, course and/or unit of study that goes towards the relevant provider meeting the qualifications standard set out in s921B(2) of the Corporations Act 2001 (Cth) by selecting the check box.

Figure 1: Screenshot of ASIC Connect: Qualifications/Training course details form

If the AFS licensee is having trouble updating the relevant provider’s qualification and training courses, see the ‘Trouble shooting’ section below.

Any other qualifications or training courses that are relevant to the provision of financial services should also be listed. But if they do not go towards the relevant provider meeting the qualifications standard, they should not be marked as such. Examples of these types of qualifications or training may include the specified courses in commercial law and taxation law or a professional designation (e.g. ‘Certified Financial Planner’).

Checking the information recorded on the Financial Advisers Register

To help AFS licensees and relevant providers determine whether incorrect and/or out of date information is recorded on the Financial Advisers Register, ASIC has updated the one-off, point-in-time dataset.

Relevant providers and AFS licensees are encouraged to check the following information on the dataset.

Qualifications

Confirm whether the relevant provider’s qualifications have been accurately recorded on the Financial Advisers Register. In particular, confirm that:

- If the relevant provider has met the qualification standard, all of the qualifications or training courses that go toward the relevant provider meeting the qualifications standard, should be recorded on the Financial Advisers Register and be marked as such, (using the check box as in the example above). These courses will be listed in column K of the dataset. See the section on ‘Qualification and training information to be recorded on the Financial Advisers Register’ above for more information,

- If the relevant provider has not met the qualification standard, none of the qualifications or training courses have been marked as a ‘qualification, course and/or unit of study that goes towards the relevant provider meeting the qualifications standard set out in s921B(2) of the Corporations Act 2001 (Cth).’ These courses will be listed in column L of the dataset.

If the AFS licensee is having trouble updating the relevant provider’s qualification and training courses, see the ‘Trouble shooting’ section below.

Common errors include, AFS licensees:

- marking the exam as a ‘qualification, course and/or unit of study that goes towards the relevant provider meeting the qualifications standard set out in s921B(2) of the Corporations Act 2001 (Cth).’ This is incorrect as the exam goes towards the relevant provider meeting the exam standard set out in s921B(3) of the Corporations Act 2001 (Cth).

- only marking a bridging unit (or some other qualification) as a ‘qualification, course and/or unit of study that goes towards the relevant provider meeting the qualifications standard set out in s921B(2) of the Corporations Act 2001 (Cth).’ These may be listed in the Determination but are required to be coupled with other qualification(s) to meet the requirements of the professional standard.

- marking a professional designation (e.g. ‘Certified Financial Planner’) as a ‘qualification, course and/or unit of study that goes towards the relevant provider meeting the qualifications standard set out in s921B(2) of the Corporations Act 2001 (Cth).’

The AFS licensee should also pay close attention to how the particulars of the qualification, course or unit of study was entered onto the Financial Advisers Register. ASIC has previously provided guidance on how to assess a relevant provider’s qualifications and enter these particulars onto the Financial Advisers Register, including:

Experienced provider pathway (EPP) declarations

Confirm whether the relevant provider is relying on the EPP and whether this is accurately recorded in column M of the dataset. If the information recorded in column I of the dataset is:

- “N” or “blank” the AFS licensee is required to confirm that the relevant provider has met the qualifications standard through formal education before 1 January 2026 and ensure that this information is accurately recorded on the Financial Advisers Register (see Qualifications above).

- “Y” the AFS licensee is required to confirm that the relevant provider has met the eligibility criteria as outlined in Information Sheet 281 Accessing the experienced provider pathway (INFO 281). If the relevant provider does not meet the eligibility criteria as outlined in INFO 281, the AFS licensee should:

- submit a maintain (update) transaction to notify ASIC that the relevant provider is not relying on the EPP, and

- confirm whether the relevant provider has met the qualifications standard through formal education before 1 January 2026 and ensure this information is accurately recorded on the Financial Advisers Register (see Qualifications above).

QTRP Capacity

Confirm whether the relevant provider has met the definition of ‘qualified tax relevant provider’ and able to provide tax (financial) advice services. Check this information to the following data in the dataset:

- whether the relevant provider is able to provide tax (financial) advice services as recorded in column H of the dataset; and

- the capacity in which the relevant provider can provide tax (financial) advice services as recorded in column I of the dataset.

If there is no response in column H of the dataset, the AFS licensee has not notified ASIC as to whether the relevant provider can provide tax (financial) advice services. The AFS license is required to submit a maintain (update) transaction and notify ASIC of whether or not the relevant provider can provide tax (financial) advice services.

If there is a “Y” response in column H of the dataset, confirm that the capacity in which the relevant provider can provide tax (financial) advice services in column I is accurate. If the information recorded in column I of the dataset is:

- “The financial adviser is also an existing provider; from 1 Jan 2026 they must have completed the specified commercial law and taxation law courses” or

- “The financial adviser is an existing provider who was a relevant provider immediately before 1 Jan 2022 and has not passed the FA exam; from 1 Oct 2022 they must have passed the FA exam, completed the prescribed commercial law and taxation law courses” or

- Blank

Confirm whether the relevant provider has completed the specified commercial law and taxation law courses.

- If ‘yes’ submit a maintain (update) transaction to notify ASIC that the relevant provider has completed the specified commercial law and taxation law courses.

- If ‘no’ submit a maintain (update) transaction to notify ASIC that the relevant provider does not provide, or intend to provide, tax (financial) advice services.*

AFS licensees have 30 business days to notify ASIC of a change to a relevant provider’s details and can do this by lodging a Maintain transaction via ASIC Connect.

*Some existing advisers may have been able to provide tax (financial) advice services until 31 December 2025 without having completed the specified courses in commercial law and taxation law. If these advisers have not completed the specified courses by 31 December 2025, AFS licensees must notify ASIC of their inability to provide these services within 30 business days of 1 January 2026.

Updating information recorded on the Financial Advisers Register

Relevant providers cannot update the Financial Advisers Register themselves. A relevant provider’s authorising AFS licensee is required to update the information recorded on the Financial Advisers Register by submitting a maintain (update) transaction via ASIC Connect.

Trouble shooting

ASIC is aware that some AFS licensees have had issues with updating the relevant provider’s details in ASIC Connect.

If a qualification or training course was previously entered, and now needs to be amended, the system requires AFS licensees to remove the qualifications and training course from the form, and then add the course again with the correct details. Importantly, this includes where the course needs to be updated to change whether it’s marked as a ‘qualification, course and/or unit of study that goes towards the relevant provider meeting the qualifications standard as set out in s921B(2) of the Corporations Act 2001 (Cth)’, using the check box, as in the example above.

If the AFS licensee is having trouble loading the ASIC Connect webpage, they should also consider clearing their cache and cookie data, as this may help with the loading time of the web page. If the issue persists, please notify ASIC by reporting a technical issue.

Additional resources

ASIC has published various resources to assist AFS licensees and their relevant providers by providing information on how to assess a relevant provider’s transcripts against the Determination and how to enter this information onto the Financial Advisers Register.