ASIC’s priorities for the supervision of market intermediaries in 2023–24

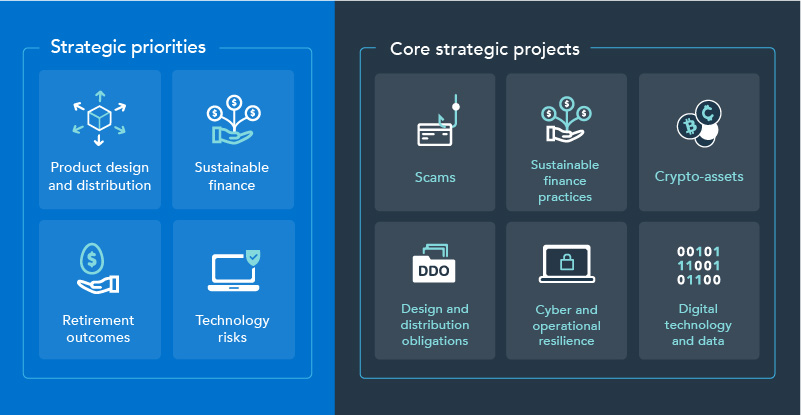

ASIC’s continuing strategic priorities, announced last year and detailed in ASIC’s Corporate Plan 2023–27, target the most significant threats and harms in our regulatory environment: product design and distribution, sustainable finance, retirement outcomes and technology risks.

To deliver on these priorities, ASIC will focus on six core strategic projects.

Supporting ASIC’s priorities and core strategic projects, our key areas of regulatory focus for market intermediaries in 2023–24 are:

- Fair and orderly markets

- Cyber, technology and operational resilience

- Product design and distribution

- Governance, accountability, sustainability and risk management

- Implementation of law reform.

Fair and orderly markets

Fair and orderly financial markets are essential to ongoing trust, confidence and participation in our financial system. Our supervisory work and enduring enforcement priorities include actions to address misconduct that harms market integrity.

- We continue real-time and post-trade surveillance of trading on Australia’s domestic licensed markets to identify insider trading, market manipulation, disorderly trading and misinformed markets. New tools are being developed and used to increase our detection of complex and novel market abuse matters, market microstructure manipulation and breaches of the market integrity rules. We continue to focus on short sale reporting and regulatory data compliance.

- As gatekeepers, market participants play an important role to lead standards of conduct. We are reviewing participants’ arrangements to prevent and detect misconduct. This includes the adequacy of order filters and controls, governance arrangements including order and trade surveillance alerts, assessment and escalation arrangements and compliance with pre-trade transparency and suspicious activity reporting obligations.

- We continue to review the trade surveillance systems used by market participants in the fixed income, currency and commodity (FICC) markets. We will focus on surveillance alerts for identifying key conduct risks, their assessment and escalation, arrangements for monitoring business communications and deterring misuse of unauthorised devices and apps, and identification of trade surveillance outages and reporting errors.

- We are leveraging our FICC market surveillance system and data analytics to identify market manipulation and other forms of misconduct in FICC markets. We are monitoring commodity derivatives markets with a focus on potential misconduct in gas and electricity markets.

- Use of our new bond surveillance capabilities will inform our surveillance of sustainable finance-related bond issuance, syndicated issues and trading in government, semi-government and corporate bonds.

- We continue to build our oversight of bond markets and consider whether public post-trade transparency would improve liquidity, market efficiency and resilience.

- We monitor the overall health of our financial markets through macro-level market quality measures such as market cleanliness, market liquidity and efficiency statistics.

- We are working to identify and take down investment scams and phishing websites. We are also working with other agencies to coordinate disruption strategies, including our joint leadership of the National Anti-Scam Centre (NASC) investment scam fusion cell with the Australian Competition and Consumer Commission. We continue to expand our communications, including through social media, to help consumers detect and avoid investment scams.

Cyber, technology and operational resilience

We will continue to supervise and engage with market intermediaries to encourage ongoing and timely management of operational risks, and continuous improvement of cyber and operational resilience practices.

- We will be reporting on our cross-industry cyber pulse survey to benchmark market intermediaries’ cyber resilience and develop sectoral insights.

- We are engaging with market intermediaries to promote good practices and support initiatives that enhance cyber resilience, including by leveraging insights from the cyber pulse survey results and heeding international warnings about account intrusions. We will take enforcement action where there are serious failures to mitigate the risks of cyber-attacks and governance failures relating to cyber resilience.

- We are partnering with other financial regulators to support whole-of-government cyber-resilience initiatives and incident responses, where appropriate.

- We are testing compliance with ASIC market integrity rules on technological and operational resilience and will continue to monitor the final steps in market participants’ and market operators’ implementation of the recommendations in Report 708 ASIC’s expectations for industry in responding to a market outage.

Product design and distribution

We will continue to pursue targeted, risk-based surveillance and take action to address poor design and distribution of retail financial products. The design and distribution obligations are intended to help consumers obtain appropriate financial products by requiring issuers and distributors to have a consumer-centric approach to designing and distributing products.

- In September 2023, we reported on our review of how retail OTC derivative issuers are meeting the design and distribution obligations to provide product issuers and distributors with practical observations about making a target market determination and meeting the reasonable steps and review obligations: see Report 770 Design and distribution obligations: Retail OTC derivatives.

- We are conducting further targeted surveillance of market intermediaries’ financial product design and distribution practices, increasing our surveillance focus on compliance with the ‘reasonable steps’ obligations.

- We are continuing to examine market intermediaries’ use of digital engagement practices (DEPs) in the marketing and distribution of financial products to identify and address poor industry practice and harmful influences on consumer behaviour and outcomes. Focus areas include gamification, notifications in trading apps, advertising and inducements (including social media), algorithmic trading and social trading features such as copy trading and leader boards.

- We are supporting the development of an effective regulatory framework for crypto-assets focused on consumer protection and market integrity, following the consultation by Treasury.

- We will take action to protect consumers from misconduct associated with crypto-assets within our remit, including those that mimic traditional products but seek to circumvent regulation. We will continue to raise public awareness of the risks of crypto-assets and decentralised finance (DeFi).

- We will take action against market intermediaries who promote and supply unsuitable structured or high-risk products to small businesses.

Governance, accountability, sustainability and risk management

We support market integrity through proactive supervision and enforcement of governance, transparency and disclosure standards. We will also continue to support effective climate and sustainability governance and disclosure.

- Together with the Reserve Bank of Australia, we are closely supervising ASX’s CHESS replacement We are seeking assurances that any gaps or deficiencies are addressed, and stakeholder concerns considered, before ASX pushes forward on its new solution and any other future programs. We will use all currently available measures to ensure that ASX meets regulatory expectations and complies with its obligations under the Corporations Act.

- We will continue to undertake frontline supervision and proactive engagement with market participants, investment banks, securities dealers and issuers of complex products to drive better practices and identify issues early. We conduct risk-based, proactive and reactive surveillance of market intermediaries’ conduct and compliance with financial services laws.

- We will continue to monitor the practices, business structures and product offerings of new and growing online trading providers. We will continue to take action where our expectations have not been met, including in relation to the supervision of authorised representatives, high-risk offers, the use of misleading and deceptive statements and client money handling practices.

- We will continue to monitor the development of artificial intelligence, data analytics and machine learning to understand the threats and opportunities for regulated entities and markets.

- We will continue to actively monitor the progress and effective completion of market intermediaries’ remediation plans and independent expert reviews (e.g. court enforceable undertakings, licence conditions and court orders).

- We continually monitor the financial strength of market intermediaries, including through testing compliance with capital and financial resource requirements using enhanced risk indicators and risk-based surveillance. We will also conduct targeted surveillance of arrangements for handling client money and safeguarding client assets.

- We will monitor sustainability-related disclosure and governance practices of our regulated populations, including listed companies, managed funds, service providers and sustainable finance bonds. We will take action against serious misconduct, including greenwashing and other false or misleading statements.

- We will continue our frontline supervision of market operators, including new product offerings (e.g. proposed equity listings on Cboe Australia). We will ensure that market operators meet regulatory expectations by promoting competition and fair, orderly and transparent markets.

Implementation of law reform

We will support market intermediaries’ implementation of law reform. We will continue to provide guidance to industry about how we plan to administer and enforce the law – especially for new obligations.

- We will continue to work with market intermediaries to ensure the objectives of the reportable situations regime are met, including by implementing solutions that will improve the consistency and quality of reporting practices and conducting targeted surveillance of entities with relatively low numbers of reportable situations. We will develop and implement a framework for ongoing publication of information about the reports received.

- We will continue to work with APRA to implement the Financial Accountability Regime by providing guidance, engaging with industry and developing effective registration and other processes.

- We have extended until 31 March 2025 transitional relief for foreign financial service providers (FFSPs) from the requirement to hold an Australian financial services (AFS) licence when providing financial services to Australian wholesale clients. We will support Treasury as it settles its policy following consultation on exposure draft legislation to provide AFS licensing exemptions for certain FFSPs.

- We will consult on automated order processing rules for futures market participants and on minor amendments to false or misleading appearance rules for securities and futures market participants.

- We are aligning the over-the-counter (OTC) derivatives trade reporting requirements in Australia with international requirements, including the unique transaction identifier, the unique product identifier and critical data elements, in preparation for the new requirements due to commence on 21 October 2024.

- We will continue to promote the development of international standards and better practices through our participation in IOSCO working groups and liaison with other local and international regulatory agencies. Areas of focus include sustainability-related financial disclosure standards, carbon markets, pre-hedging practices, retail market conduct, DEPs, crypto assets and DeFi, vulnerabilities in markets for leveraged loans and collateralised debt obligations and emerging retail market conduct issues.

- We will continue to publish a six-monthly regulatory developments timetable with expected timeframes for ASIC’s regulatory work. To stay informed about regulatory developments and issues affecting market intermediaries, we also recommend subscribing to our monthly newsletter and participating in our quarterly Market Liaison Meetings.

Conclusion

We encourage you to use these priorities as a reference tool for your compliance, supervisory and risk management programs, and to prepare for your interactions with ASIC.

We remain committed to using the full range of ASIC’s powers, including enforcement action, to preserve the integrity of the Australian financial markets. Our updated enforcement priorities for 2024 will be published later in the year to align with the changing economic conditions and emerging trends and risks outlined in ASIC’s corporate plan.