Using ASIC's reverse mortgage calculator

This is Information Sheet 185 (INFO 185). It outlines how credit licensees should use the reverse mortgage calculator on ASIC's Moneysmart website.

This information sheet sets out:

- an explanation of the reverse mortgage calculator

- how we expect you to use the calculator to meet your responsible lending obligations for reverse mortgages under the National Consumer Credit Protection Act 2009 (National Credit Act) and the National Consumer Credit Protection Regulations 2010 (National Credit Regulations)

- information to help you use the calculator effectively.

What is the reverse mortgage calculator?

The calculator on ASIC's Moneysmart website is designed to help consumers understand the effect a reverse mortgage may have on the equity in their home by projecting:

- how much their debt will increase over time, and what this may mean for the equity in their home

- how changes in interest rates and house prices could affect the equity in their home.

Collectively, these projections are known as the 'equity projections'.

The calculator also allows credit licensees to meet their responsible lending obligations under the National Credit Act.

The reverse mortgage calculator is available on the Moneysmart website. We have approved this webpage, including the instructions for the making of equity projections set out in the calculator, for the purposes of section 133DB(1)(a) of the National Credit Act and regulation 28LD(2) of the National Credit Regulations.

When must I use the calculator?

If you are a credit licensee, you must use the calculator to make equity projections to show a consumer before you make a preliminary or final assessment of unsuitability about a reverse mortgage: see section 133DB of the National Credit Act.

To meet your obligations, you must show or give a consumer the equity projections for the three scenarios set out in Table 1.

Table 1: Scenarios that must be shown to a consumer using the calculator

|

Element |

Scenario 1 |

Scenario 2 |

Scenario 3 |

|

Description |

How much a consumer's debt will increase over time and the effect on the equity they hold in their home. |

How a consumer's equity will be affected if their home value remains constant over time. |

How a consumer's equity will be affected if interest rates are 2%higher. |

|

Projected annual change in property value |

3% per annum. |

0% per annum. |

3% per annum. |

|

Option 1: Default interest rate |

7% per annum. |

7% per annum. |

9% per annum. |

|

Option 2: Known interest rate |

If known, the annual percentage rate (APR) that applies to the reverse mortgage (e.g. 6.74% per annum). |

If known, the APR that applies to the reverse mortgage (e.g. 6.74% per annum). |

If known, the APR that applies to the reverse mortgage, increased by 2% (e.g. 8.74% per annum). |

You may show a consumer the equity projections, or give the equity projections to the consumer by mail, email, or any other written or electronic communication agreed to by the consumer.

However, you must also provide the consumer with a printed projection of each scenario. This obligation is separate from the obligation to show or give the equity projections to the consumer, but it may be satisfied if the equity projections are given to the consumer in printed form. For more information about the printed projections, see 'Step 7: Print results'.

What are the other uses of the calculator?

The calculator may be a useful tool to help you meet your general responsible lending obligations to:

- make reasonable inquiries about the consumer's requirements and objectives, including the consumer's current financial circumstances and possible future needs (see sections 117 and 130 of the National Credit Act)

- make a preliminary or final assessment of unsuitability based on the inquiries you have made (see sections 118 and 131 of the National Credit Act).

You may generate additional equity projections as part of an ongoing discussion with the consumer to:

- best reflect the consumer's particular circumstances – for example, if it is reasonable to expect that the consumer's future life expectancy will be greater than 15 years (the default time period for the calculator's projections)

- inform and test the consumer's assumptions about their requirements and objectives

- help the consumer understand how a reverse mortgage may affect the equity they hold in their home.

See Regulatory Guide 209 Credit licensing: Responsible lending conduct (RG 209) for further guidance.

Note: On 25 September 2020, the Government announced proposed reforms to the responsible lending obligations contained in Ch 3 of the National Credit Act. The proposed reforms will amend the obligations that apply before entry into a credit product or the provision of credit assistance. ASIC’s guidance relating to the current responsible lending obligations will be reviewed and updated when the proposed reforms are finalised.

How do I use the reverse mortgage calculator?

Open the reverse mortgage calculator on the Moneysmart website.

The information set out below will help you use the calculator to meet your obligations.

Choose the lender

Choose the relevant lender from the 'Select lender and product' drop-down menu in the top-right corner of the first page. This will apply the lender's borrowing limits, including their loan-to-valuation ratio (LVR), minimum borrowing age and maximum loan amount

If you are a broker, select the lender whose reverse mortgage you are providing credit assistance in relation to.

In limited circumstances, you may want to remove borrowing limits (e.g. restrictions to LVR or maximum loan amount). If this is the case, select the option 'Other (no loan restrictions)' from the 'Select lender and product' drop-down menu.

Step 1: Check the consumer's circumstances

This section of the calculator, titled 'Your circumstances', highlights three issues that may be relevant to the consumer:

- the presence of tenants who will not be co-borrowers

- whether the consumer would be eligible for the Pension Loans Scheme

- how a reverse mortgage would affect the consumer's Centrelink payments.

The calculator will provide some information in response to the answers that are selected.

Step 2: Enter the consumer's details

In this section of the calculator, titled 'About you', you must enter the personal details relevant to the consumer (i.e. the age of the youngest borrower, the current value of their security property and the assumed annual change of that value).

The current house value should reflect a reasonable assessment of the value of the consumer's home. You can determine the value of the consumer's home through:

- an independent valuation

- council rates assessments, or

- recent sales history of similar properties in that area.

The assumed annual increase in house value will default to 3% per year.

Step 3: Enter payment amounts

In this section of the calculator, titled 'Borrowing plan', you must enter the consumer's preferred payment type and amount. This can be a lump-sum payment, regular payments, or both.

There is a limit of five non-recurrent lump-sum payments. If the consumer intends to borrow more than five separate lump sums over the course of the reverse mortgage, we suggest you estimate the average yearly drawdown and put the amount under 'regular payments' per year.

When entering the payment amounts, you must consider the presumptions of unsuitability set out in regulation 28LC of the National Credit Regulations: see Section C of RG 209 for further information.

The calculator will prevent you from calculating a payment amount when the LVR exceeds the prescribed amounts for the reverse mortgage selected.

Note: If the consumer is uncertain about their preferred payment amount, you should consider re-assessing their borrowing plan (see 'Review borrowing plan') or providing them with additional projections for other amounts.

Step 4: Enter the reverse mortgage costs

The interest rate in the section of the calculator titled 'Cost of your loan' will automatically be set to 7% per year. If the APR is available, you can enter the APR that applies to the reverse mortgage.

You must also enter the costs relevant to the reverse mortgage. This includes:

- the applicable establishment fees

- the ongoing fees (these can be entered on a yearly, quarterly, monthly, fortnightly or weekly basis).

Step 5: Generate your projection and compare custom scenarios

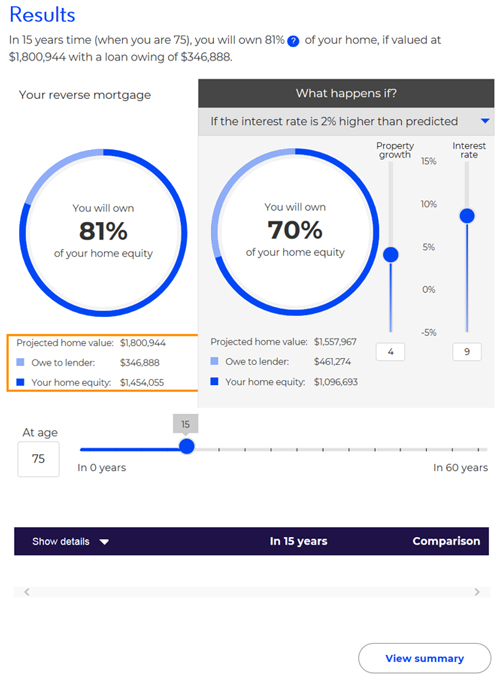

This section of the calculator, titled 'Results', creates a simplified summary of your reverse mortgage based on the values you provided. You can move the timeline or set the age to see how the consumer's home equity is affected by the loan at any point in the future: see Figure 1.

Figure 1: Screenshot of 'Results' section of calculator

(click to enlarge)

Click on the 'Show details' button at the bottom left for a comprehensive breakdown of the costs involved with the reverse mortgage.

You can also click on the 'What happens if?' button to change the assumptions about future house value and interest rates. Selecting Scenario 2 (0% property growth) or Scenario 3 (2% higher interest rates) from the drop-down menu will automatically re-set the results using the values of those scenarios. You can also nominate custom values. This will generate a new column, called 'Comparison', in the 'Show details' section.

However, please note that putting in custom values will not change the results in the detailed report at 'Step 7: Print results'.

Review borrowing plan

If you or the consumer considers that the amount proposed to be borrowed does not meet their requirements or objectives, you may review that amount at this point and change accordingly.

Step 6: Review inputs and add notes

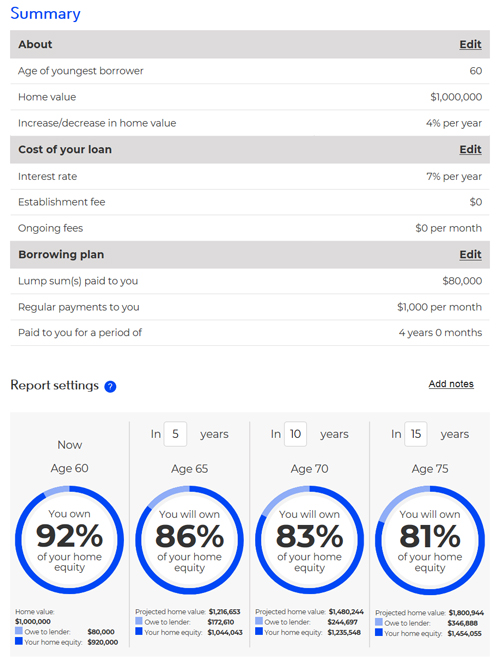

If you select the 'View summary' button at the bottom of the page, you can see how the consumer's debt affects their home equity over time: see Figure 2.

Figure 2: Screenshot of reverse mortgage calculator summary

(click to enlarge)

The 'Edit' link next to each topic heading will allow you to go back and alter the inputs if needed. If you click the 'Add notes' link, you can enter your contact details and additional information for the client's reference (this is optional).

If the consumer knows the anticipated duration of their loan, you should insert that value above the second chart in 'Report settings' (in Figure 2, we have set this to 5 years). The second and third charts should be set to 5 and 10 years beyond this anticipated duration respectively (in Figure 2, we have set these to 10 and 15 years). These details will appear in the final printout.

Step 7: Print results

If you and the consumer are satisfied with the inputs, click on the 'Print results' button to view a detailed report on the reverse mortgage. The report will include the assumptions, disclaimers and important information.

The document will automatically print equity projections for all three scenarios.

You may show or give the consumer a copy of the printed equity projections, including associated materials, at this point. All printed copies that are given to the consumer should be in colour. The equity projections can also be given to a consumer by mail, email, or any other written or electronic communication agreed to by the consumer.

The consumer should be given a reasonable time to review these projections and consider their current and future circumstances.

Where can I get more information?

- Read the National Credit Act and National Credit Regulations

- Read RG 209 Credit licensing: Responsible lending conduct

- Visit our Credit pages for the latest information on credit and to download related regulatory guides

- Visit the Moneysmart website for credit information and resources for consumers

- Contact ASIC on 1300 300 630

Important notice

Please note that this information sheet is a summary giving you basic information about a particular topic. It does not cover the whole of the relevant law regarding that topic, and it is not a substitute for professional advice. We encourage you to seek your own professional advice to find out how the applicable laws apply to you, as it is your responsibility to determine your obligations.

You should also note that because this information sheet avoids legal language wherever possible, it might include some generalisations about the application of the law. Some provisions of the law referred to have exceptions or important qualifications. In most cases, your particular circumstances must be taken into account when determining how the law applies to you.

Information sheets provide concise guidance on a specific process or compliance issue or an overview of detailed guidance.

This information sheet was issued in October 2020.